FAQ 0840 840 820 (Gratisnummer innerhalb der Schweiz) studentservices@fernuni.ch

Master-Programm

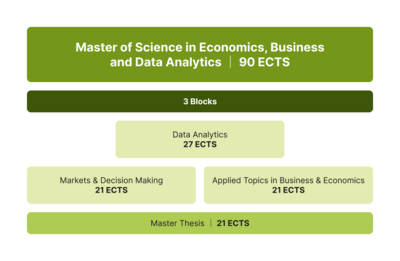

Der Master-Studiengang ist in drei Modulblöcke und eine Master-Arbeit unterteilt und umfasst insgesamt 90 ECTS:

- Data Analytics (27 ECTS, 3 Pflichtmodule)

- Markets and Decision Making (21 ECTS, 3 Pflichtmodule)

- Applied Topics in Business and Economics (21 ECTS, drei von sechs Modulen nach Wahl). Sie können sich spezialisieren und entweder die drei Managementmodule oder die drei Wirtschaftsmodule belegen oder sich nicht spezialisieren und die Modulkombination, die Ihnen am besten gefällt, frei wählen

- Master-Arbeit (21 ECTS)

Die Liste der Module und das gesamte Programm sind auch in den Anhängen zum Studienreglement zu finden.

Pflichtmodul(e)

This course module discusses several of the most practically relevant econometric and statistical methods for empirical research and data analytics (e.g. in economics and social sciences) along with their underlying assumptions and properties. It also presents applications of these methods in real-world data using the statistical software “R (studio)”. The course module consists of a lecture and 4 PC lab sessions (quizzes). This course consists of asynchronous independent study periods, 5 online meetings, and 4 PC labs and quizzes. The topics covered in the lecture include:

1. The difference between causation (e.g. education has a causal effect on wage) and correlation (subjects with higher education have higher wages, but this may be driven by other factors than education as for instance ability); the intuition of experiments for assessing causation.

2. Linear regression (OLS - ordinary least squares) to assess the association of one or several variables (e.g. education, age,...) with an outcome of interest (e.g. wage).

3. Quantile regression to conduct empirical analyses at particular outcome ranks (e.g. for the median earner in the wage distribution).

4. Nonlinear regression (probit regression for binary outcomes like working vs. not working, tobit regression for censored outcomes).

5. Flexible methods for causal analysis (such as for evaluating the effect of training on earnings): matching, inverse probability weighting, doubly robust estimation.

6. Instrumental variable regression to assess the effect of endogenous variables (that are not random).

7. Regression discontinuity designs to assess the effect of a variable (e.g. health treatment) which is assigned based on a running variable (e.g. health index).

8. Panel data regression and “Differences-in-Differences” estimation when subjects are observed at several points in time.

9. Synthetic control methods for evaluating the effect of an intervention (e.g. of a health policy) on a single unit (e.g. a single region introducing the health policy).

10. Bootstrapping (resampling from the original data, e.g. for variance estimation).

11. Time series regression, e.g. for modeling stock prices or GDP growth over time.

Mandatory literature

- Martin Huber: Causal Analysis. Impact Evaluation and Causal Machine Learning with Applications in R. The MIT Press (2023).

- Jeffrey M. Wooldridge: Econometric Analysis of Cross Section and Panal Data. Second Edition. The MIT Press (2010).

Excerpts of both texts are available in electronic from (PDF) on the Moodle platform of this module.

(Spring Semester 2026)

This course provides an exploration of key issues and concepts in machine learning, with an emphasis on practical applications in business and management. Students will understand the difference between predicting outcomes and identifying cause-and-effect relationships, study regularised regression techniques such as Lasso and Elastic Net, explore tree-based methods such as Random Forest, and learn about resampling methods such as bagging and cross-validation. The course also covers deep learning and unsupervised machine learning techniques. In addition, students will be introduced to some advanced topics such as causal machine learning and LLMs. Using a hands-on approach and the industry-standard software R, the course facilitates the practical application of theoretical concepts and ensures that students gain practical skills in implementing machine learning models.

Agenda:

• Block 1: Introduction

• Block 2: Regularised Regresssion

• Block 3: Trees and Deep Learning

• Block 4: Unsupervised ML

• Block 5: Advanced ML Topics

Teaching videos and accompanying slides, exercises, codes and research papers will be posted on Moodle.

Main Textbook: “Introduction to Statistical Learning with Applications in R”, James Gareth, Daniela Witten, Trevor Hastie, Robert Tibshirani, download on Moodle.

(Spring Semester 2026)

This seminar module provides an opportunity to apply theoretical knowledge from econometrics to real-world data. It focuses on the application of statistical methods such as regression analysis, causal inference, and machine learning techniques. Participants will work on group projects to gain experience in data analysis, interpreting results, using econometric software, and engaging with academic literature and writing. Participants present their project findings and actively contribute to discussions of peer projects.

(Spring Semester 2026)

Dozent/in

Assistierende

A major part of economic activity takes place within or between organisations. In particular, many complex transac-tions can only be carried out with the involvement of organisations. It is thus crucial for economists and managers to understand the economic purpose of organisations, how organisations function, and how they should be de-signed.

The module consists of two parts. The first sheds light on the fundamental questions of why firms exist and what their boundaries should be. We cover classic and more recent theories of the firm to understand firm scope and to analyse decisions of vertical integration and outsourcing. The second part investigates the internal organisation of firms and how they should be designed to reach their goals. We rely on theories from economics, management, and related fields to analyse how explicit and implicit incentives affect performance and how organisations can design their incentive systems to motivate employees. Across all topics, we rely on empirical evidence in the form of field data, experiments, and case studies to critically evaluate and, if possible, further develop the theories.

Key themes and concepts:

Part I – Foundations and Boundaries of Organisations:

• Incomplete contracts

• Relationship-specific investments and hold-up

• Transaction Cost Economics

• Property Rights Approach

• Contracts as Reference Points

Part II – Motivation Problem and the Internal Organisation of Firms:

• Principal-Agent model

• Performance pay

• Multi-tasking

• Ratchet effect

• Tournament theory

• Intrinsic motivation and social motivators

(Autumn Semester 2025)

This module introduces students to economic approaches for understanding, analysing, and evaluating human decision making. Session I starts a selected collection of common bias and heuristics that are often observed in human decision making. Session II introduces the economic foundations of decision making such as basic concepts of preference, axioms, states, acts, and outcomes. We will use decision tree to describe simple decisions under uncertainty, and discuss several systematic, empirical deviations from the expected utility theory (EUT). Session III deals with decision making for future selves. Session IV investigates decision making with strategic interactions. We will introduce game theory and a variety of typical strategic constellations as well as several useful solution concepts.

Finally, Session V presents organisational decision making and a touch of policy implications from natural experiments.

Teaching videos and accompanying research papers and book chapters will be posted on Moodle before each session.

The case studies will be made available on Moodle at the beginning of the semester.

(Spring Semester 2026)

Dozent/in

Assistierende

This comprehensive module is designed to equip aspiring entrepreneurs and innovators with the essential knowledge and skills needed to transform ideas into successful ventures. It combines academic discussion with hands on experience. Throughout this course, you will explore key concepts such as identifying business opportunities, developing compelling value propositions, creating effective business models, and defining a funding strategy to scale your startup. By the end of the module, you will have a solid foundation in innovation and entrepreneurship, ready to turn your visionary ideas into reality.

The module covers five main themes:

1. Introduction to Innovation and Entrepreneurship

o Key Terminology: Understanding essential terms such as startup, business model, innovation, and market analysis.

o Importance of Innovation: Exploring how innovation drives business success and competitive advantage in various industries.

o Entrepreneurial Process: Overview of the basic steps involved in launching a startup, including idea generation, market research, business model development, securing funding, and scaling.

2. Identifying Opportunities

o Methods for Identification: Analytical methods like market research, SWOT analysis, trend analysis, user innovation to identify potential business opportunities.

o Types of Opportunities: Differentiating between market-driven, technology-driven, and problemsolving opportunities.

o Viability Analysis: Conducting analyses on case studies to evaluate the feasibility of different business ideas.

3. Developing a Value Proposition

o Value Proposition Concept: Understanding what a value proposition is and its critical role in business strategy.

o Components of a Value Proposition: Identifying key elements such as customer segments, customer jobs, pains, gains, products & services, pain relievers, and gain creators.

o Creating a Value Proposition: Using the Value Proposition Canvas to develop a clear and compelling value proposition for a business idea.

4. Creating a Business Model

o Business Model Components: Learning about the nine components of the Business Model Canvas: Customer Segments, Value Propositions, Channels, Customer Relationships, Revenue Streams, Key Resources, Key Activities, Key Partnerships, and Cost Structure.

o Building a Business Model: Constructing a comprehensive business model using the Business Model Canvas.

o Evaluating Business Models: Critiquing and providing feedback on business models to improve their effectiveness and feasibility.

5. Funding and Scaling Up

o Sources of Funding: Exploring different funding options available to entrepreneurs, including venture capital, angel investors, crowdfunding, and bootstrapping.

o Developing a Funding Strategy: Creating a funding strategy that outlines potential investors, funding stages, and capital needs.

o Growth requirement: Evaluating how quick the startup needs to grow to build a competitive advantage.

6. Pitch Deck Creation:

o Designing a professional pitch deck to present a business idea to potential investors, including key elements such as problem statement, solution, market opportunity, business model, traction, financial projections, and funding request

Articles, videos, cases, and exercises will be posted on Moodle.

No specific book

(Autumn Semester 2025)

Dozent/in

Assistierende

Every student writes a Master's thesis in the course of their Master's degree program.

Dozent/in

Wahlmodule - Schwerpunkt Management

This module provides master students with a comprehensive introduction to marketing and consumer behavior. The conceptual foundations of marketing and consumer behavior form the core of the course. The course is structured around four different perspectives on marketing.

• Theoretical perspective

• Information-related perspective

• Strategic perspective

• Instrumental perspective (marketing mix)

Within this structure, current developments in marketing and consumer behavior are discussed (e.g., AI in marketing, current research findings), and different tools to measure and analyze consumer behavior are introduced in R exercises. It is demonstrated how you can draw sound conclusions from such analyses and translate these conclusions into a coherent marketing strategy.

Resources will be posted on Moodle:

• Teaching videos

• Slides

• Research papers

• Exercises / case studies

• R scripts

• Supplementary materials (links, books, etc.)

(Spring Semester 2026)

This class will be building on major leadership and business ethics theories with the aim to offer concrete recommendations for individuals who want to become more leader-like, effective, and ethical in a formal leadership role. This module is made of two different parts, which are inherently linked with one another.

The first part will investigate leadership theories. It will focus on the mindful engagement model as a systematic model to approach one’s development as a leader, review the large literature on personality traits to better understand the origin of one’s own behaviours, and discuss the full range model of leadership with its four styles: Transactional, Instrumental, Transformational, and Charismatic. We will also discuss how the effectiveness of leadership styles depends on the specific context and national culture.

In the second part, we will start by discussing the relevance of business ethics for managers. We will start by reviewing the major philosophical approaches that inform morality and underpin major managerial decisions. We will then apply these principles to different concrete business cases, helping students distinguish among the different morality approaches. Finally, we will discuss contemporary cases and important ethical questions for managers.

Key concepts seen in this class include (among others):

Part 1:

• Trait theories of leadership

• Leadership behaviors and styles

• Charismatic leadership

• Contextual leadership

• Cross-cultural leadership

Part 2:

• Ethics

• Morality

• Critical thinking

• Philosophy and decision making

• Grand business challenges

All materials posted on Moodle will be relevant for the final exam (unless explicitly stated). There is no compulsory book reading but students will be asked to read the following scientific articles throughout the semester:

• Ashford, S. J., & DeRue, D. S. (2012). Developing as a leader: The power of mindful engagement.

Organizational Dynamics, 41(2), 146-154.

• Bastardoz, N. (2020). Signaling charisma. In Zuquete, P., The Routledge International Handbook of Charisma, 313-323.

• Lemoine, G. J., Hartnell, C. A., & Leroy, H. (2019). Taking stock of moral approaches to leadership: An integrative review of ethical, authentic, and servant leadership. Academy of Management Annals, 13(1),148-187.

• Vroom, V. H., & Jago, A. G. (2007). The role of the situation in leadership. American Psychologist, 62(1),17-24.

Further readings for interested students will be provided but will not be exam material.

(Autumn Semester 2025)

This course offers a comprehensive framework for understanding how firms achieve and sustain competitive advantage. It focuses on two key themes:

1. Corporate Strategy – exploring the question of which industries a firm should compete in.

2. Competitive Strategy – examining how a firm can effectively compete within its chosen industries.

To address these critical questions, the course covers a range of interconnected topics, including:

• The horizontal and vertical boundaries of a firm

• The resource-based view of competitive advantage

• Value creation and value capture

• Imitation barriers and sustaining advantage

• Agency theory and its implications

Additionally, the course explores emerging developments, with a special focus on how artificial intelligence is reshaping strategy and competitive dynamics.

The course employs a blended learning approach, combining pre-recorded and live lectures, online quizzes, handson experiments, and in-depth case study analyses. This interactive format ensures students not only grasp theoretical concepts but also develop practical skills for real-world strategic decision-making. By the end of the course, students will be equipped to critically analyze strategic challenges, formulate effective strategies, and navigate the complexities of competitive and corporate environments.

Compulsory Readings:

Besanko, D., et al., (2017). Economics of Strategy (7th Edition) John Wiley & Sons.

Specific papers and book chapter will be provided during the course on the platform Moodle

Additional Readings:

Johnson G., et al., (2017). Exploring Strategy (11th Edition) Pearson

(Spring Semester 2026)

Wahlmodule - Schwerpunkt Economics

We live in an increasingly digital world and economy. Information technologies have already transformed the way business is done and will continue to do so. This course covers basic theory in digital economics, for instance, network effects, pricing models, and multi-sided markets.

Key concepts include:

▪ Macroeconomics of the Internet: Understanding the broad economic impact and dynamics of the internet.

▪ Business Strategy in Digital Markets: Approaches and considerations for strategic decision-making in online environments.

▪ Regulation in Digital Markets: Overview of key regulatory frameworks affecting digital businesses and consumers, including infrastructure and privacy regulations.

▪ Platform Economics: Analysis of economic principles governing platform-based businesses, including governance, competition, and advertising.

▪ Economics of Data and AI: Exploration of the economic implications of data usage and artificial intelligence, with a focus on privacy, labor markets, and competition.

Shapiro, C. and Varian, H.R., 1998. Information Rules: A Strategic Guide to the Network Economy. Cambridge, MA: Harvard Business School Press. (don’t be discouraged by the book’s age! It’s an absolute classic!)

Waldfogel, J., 2018. Digital Renaissance: What Data and Economists Tell Us About the Future of Popular Culture.

Princeton, NJ: Princeton University Press.

Goldfarb, A. and Tucker, C., 2019. Digital economics. Journal of Economic Literature, 57(1), pp.3-43.

Agrawal, A., Gans, J. and Goldfarb, A., 2022. Prediction Machines, Updated and Expanded: The Simple Economics of Artificial Intelligence. Revised edition. Boston, MA: Harvard Business Review Press.

(Autumn Semester 2024)

Dozent/in

Assistierende

This course provides an in-depth exploration of the interplay between economic development, sustainability, and growth. Through theoretical and applied frameworks, students will engage with historical and contemporary challenges, considering how innovation, institutions, geography, and inequality shape sustainable pathways. Interactive discussions, case studies, and empirical evidence will enhance understanding.

Session 1: A Brief History of World Economic Development

Objective: Establish a foundational understanding of growth and sustainability.

Topics:

• Measuring economic performance: material vs. multi-faceted well-being (e.g., HDI, happiness).

• Historical trends in economic development and pollution/emissions.

• Malthusian trap

• Stylized facts of growth: global inequalities, convergence/divergence, carbon leakage, and decoupling.

Session 2: Proximate Drivers of Growth (Physical and Human Capital, Technology)

Objective: Understand the role of human capital and innovation in sustainable growth.

Topics:

• Human capital as a driver of productivity and innovation.

• Education's dual role: fostering innovation and addressing environmental challenges.

• The link between innovation and sustainable technologies.

Session 3: Institutions and Culture in Sustainable Growth

Objective: Explore how institutions and culture shape sustainable growth.

Topics:

• Governance: property rights, anti-corruption, and stability.

• Cultural attitudes: trust, cooperation, and environmental behavior

Session 4: Geography, Natural Resources, and Trade

Objective: Analyze the role of geography and trade in shaping sustainable development.

Topics:

• Geographic determinants: climate and resource sustainability.

• Resource management and the risk of resource curse.

• Environmental impacts of global trade and production chains.

Session 5: Inequality, Conflict, Planet Boundaries, and Future Pathways

Objective: Examine challenges to sustainable growth and propose forward-looking solutions.

Topics:

• Balancing inclusiveness and efficiency in growth.

• Economic and environmental drivers of conflict and migration.

• Decoupling growth from environmental degradation through technology, policy, and lifestyle shifts.

• Geoeconomic fragmentation of global trade.

Teaching videos and accompanying research papers and book chapters will be posted on Moodle.

(Spring Semester 2026)

This course focuses on the role of government policy in a market economy and on the challenges that arise in the context of the regulation of externalities and generating government revenue. It covers the theoretical and empirical evaluation of public policy as applied to a diverse set of important economic problems such as, for instance, firm concentration and market power, climate change and scarcity of natural resources, or inequality and redistribution.

Noch Fragen?

Unsere Student Manager sind für Sie da!